3 min read through

Take a look at how I’m trading a single of the last remaining arbitrage methods.

In recent a long time, the phrase “arbitrage” has been thrown around more and much more, specifically just after the rise of cryptocurrencies. But most situations, it is utilised improperly and describes approaches with far larger threats than perceived. So I’m likely to make it ideal. Here, we go in excess of buying and selling an actual arbitrage in are living marketplaces.

Background

Dual-Course arbitrage is one particular of the extra easy kinds of arbitrage. It will involve building a income from the distinction in returns of stocks that have dual listings (e.g. “GOOG” and “GOOGL”, “BRK-B (Berkshire Hathaway)” and “BRK-A”). Let us dive deeper into what that means.

Organizations sometimes go general public supplying two lessons of shares. Employing Google, like in the instance over, the Class A shares are represented by the ticker symbol(“GOOGL”) and the Course C shares are represented by the ticker image (“GOOG”). As is commonly the circumstance, this twin-listing is carried out so that the founders can keep disproportionate ownership of the firm whilst continue to staying general public. Class A shares normally maintain much more voting rights, so founders and first investors are typically the premier holders.

Because of this voting suitable gain, occasionally Course A shares might charge much more than Class C shares (e.g. Class A = $100, Class C = $99.75), this is normal and in line with anticipations. However, the two shares stand for the exact same firm and equally shares generally have equivalent sector capitalizations as there are no other differences.

The arbitrage possibility exists when both share is around/under valued in contrast to the other. For example, if there is a extremely substantial market purchase for GOOG that pushes the value up by .50%, but no this sort of purchase existed for GOOGL, then GOOG will be .50% much more beneficial than GOOGL. An arbitrageur will see this imbalance and quick GOOG shares and extended GOOGL shares. As the imbalance corrects, they make income from each legs with no directional danger. A genuine arbitrage.

Nicely, I am that arbitrageur.

The Trade

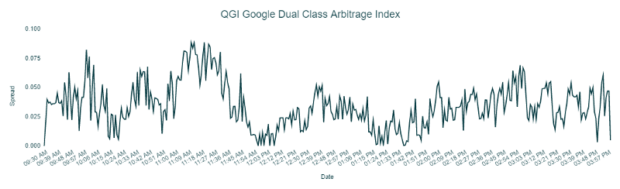

Figuring out that Google shares are the most liquid and can handle scaling up this kind of inefficiency, I loaded up the QGI Google Twin-Class Arbitrage Index:

https://qg-indices.com/qgi-google-dual-class-arbitrage-index-delayed/

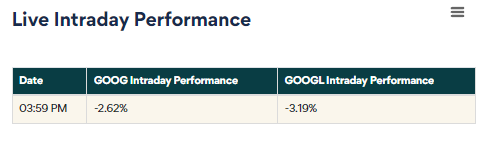

The extensive-phrase common unfold of this index is , so just about every time that it goes higher than my personal threshold (commonly .25 or better), I enter into a pairs trade. Since the around/less than performer may well adjust in excess of time, the overall performance of each and every share is posted are living. All over again, the trade is to purchase the shares that are underperforming, and brief the shares that are overperforming.

In this case, GOOG is the “overperformer” and GOOGL is the “underperformer”. “Overperformer” interprets to the inventory which is holding itself up greater than the other.

So, let us go over how my previous several trades went:

General performance

Each time the index rose previously mentioned .25, I bought the underperformer and went brief the overperformer. So much, I have only taken one trade per working day for this strategy, but the spread widens constantly. If automated, this approach can frequently examine facts from the index and scalp away the arbitrage without any guide labor. The returns can be even bigger if traded together with the other arbitrage indices.

In the trades higher than, I manufactured $9.18 on ~$1,000 of capital for a return of .92% (If using margin, then it is $500 of cash for ~ a 1.84% return). The whole mixed keeping time was 9 minutes. The most drawdown was non-existent as we are both equally shorter and long the precise identical security, just distinct courses. Yet another reason for the non-existent drawdown is that trades are set on simultaneously.

Hypothetically, if I do nothing but trade this arbitrage when every single 3 buying and selling days out of the week (or at most, each and every day the index boosts), then the returns are staggering:

Challenges

As weird as it may seem, the very definition of arbitrage as defined by Nasdaq, is “Riskless arbitrage: The simultaneous order and sale of the exact asset to produce a earnings”.

The key pitfalls to this approach occur from exterior factors, right here are a couple:

- There are a handful of of these indices which cover various stocks, some of them could not have the liquidity to assistance large positions.

- From time to time outlier occasions transpire, like in the Archegos incident. In that situation, a significant hedge fund liquidation led to the course A shares of Discovery Inc. sinking by virtually 40%, but the class B shares only went down by 7%. The imbalance persisted right until an acquisition delisted equally shares. If an arbitrage system decided to enter into a trade dependent on this discrepancy, it would have missing revenue. When terribly uncommon, these types of shocks do happen.

The reason for these kinds of a flat danger profile is that we are trading the exact asset. Contrary to normal pairs buying and selling which trades correlated shares which might run into correlation decay, dual-mentioned stocks are extra than correlated, they’re intrinsically joined. The industry capitalization of both of those shares have to be the exact as they both of those depict shares of Alphabet, Inc. When they go out of whack, the mispricing is corrected by trades these types of as these.

I was mainly influenced to try out investing this manually by the tutorial underneath:

Last Ideas

Now that I now it can be performed by retail traders, I program to do a deeper dive on automating this tactic across a number of stocks. You’ll be able to discover it on The Quant’s Playbook!

If this whet your appetite, and you’d like to browse a lot more like it, head more than to The Financial Journal household to the best stories and updates on facet hustles, fiscal marketplaces, and a lot more!

Content investing!

More Stories

Artificial Intelligence Can Improve Building Security

Amazon, Google, and Meta’s big bets didn’t pay off in 2022

TikTok recognised as a threat by US Government